The Basic Principles Of Hard Money Atlanta

Wiki Article

The Main Principles Of Hard Money Atlanta

Table of ContentsTop Guidelines Of Hard Money Atlanta3 Simple Techniques For Hard Money AtlantaThe smart Trick of Hard Money Atlanta That Nobody is Talking About10 Simple Techniques For Hard Money Atlanta

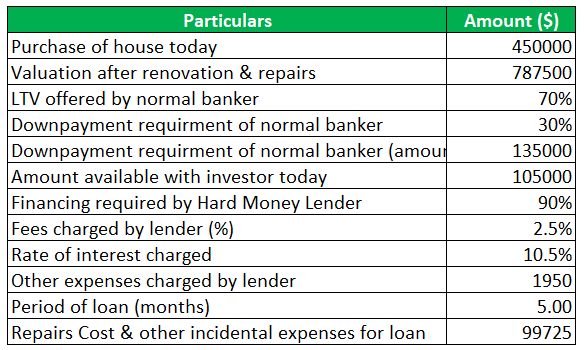

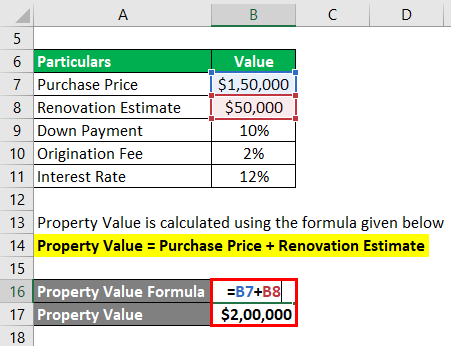

By contrast, passion prices on hard cash finances start at 6. Difficult cash loan providers typically charge points on your car loan, in some cases referred to as origination costs.

Factors are generally 2% to 3% of the funding amount. Three factors on a $200,000 car loan would be 3%, or $6,000.

Indicators on Hard Money Atlanta You Need To Know

You can anticipate to pay anywhere from $500 to $2,500 in underwriting fees. Some hard cash lenders likewise charge prepayment charges, as they make their cash off the interest charges you pay them. That means if you pay off the funding early, you might have to pay an extra cost, including in the finance's price.This indicates you're most likely to be provided financing than if you got a standard mortgage with a suspicious or thin credit rating. hard money atlanta. If you need cash swiftly for remodellings to turn a house for earnings, a difficult cash funding can give you the cash you require without the trouble as well as paperwork of a standard mortgage.

It's a method capitalists use to acquire investments such as rental residential or commercial properties without utilizing a lot of their very own properties, as well as tough money can be beneficial in these scenarios. Although difficult cash car loans can be valuable for real estate capitalists, they should be utilized with care specifically if you're a newbie to property investing.

With much shorter payment terms, your month-to-month settlements will certainly be much more pricey than with a normal home mortgage. If you skip on your funding repayments with a difficult money lender, the consequences can be severe. Some car loans are directly guaranteed so it can damage your credit history. As well as since the finance is protected by the home in question, the lender can occupy and also seize on the home because it acts as collateral.

The Ultimate Guide To Hard Money Atlanta

To locate a trustworthy lender, talk with trusted realty representatives or home loan page brokers. They may have the ability to refer you to lenders they have actually worked with in the past. Tough cash loan providers also usually go to genuine estate financier meetings to make sure that can be an excellent location to link with lending institutions near you. hard money atlanta.Equity is the value of the residential or commercial property minus what you still owe on the home loan. Like hard money financings, residence equity loans are secured financial obligation, which indicates your property works as collateral. However, the underwriting for home equity car loans likewise takes your debt background and also revenue right into account so they often tend to have reduced rate of interest prices and also longer payment periods.

When it comes to moneying their following deal, real estate investors as well as business owners are privy to numerous providing choices basically created real estate. Each comes with specific requirements to access, and if made use of effectively, can be of massive benefit to capitalists. One of these lending kinds is hard money borrowing. hard money atlanta.

It can also be described an asset-based loan or a STABBL funding (temporary asset-backed bridge lending) or a bridge finance. published here These are derived from its particular short-term nature as well as the demand for concrete, physical collateral, usually in the type of genuine estate residential or commercial property.

6 Simple Techniques For Hard Money Atlanta

They are considered temporary swing loan as well as the major use instance for tough cash finances remains in realty transactions. They are considered a "hard" cash lending as a result of the physical property the actual estate home required to safeguard the finance. On the occasion that a customer defaults on the car loan, the loan provider reserves the right to think possession of the residential property in order to recoup the lending sum.As a result, needs might differ considerably from loan provider to lender. If you are looking for a loan for the very first time, the authorization procedure could be fairly stringent as well as you might be needed to give additional info.

This is why they are mainly accessed by realty entrepreneurs that would usually require fast funding in order to not lose out on hot chances. In enhancement, the lending institution primarily takes into consideration the value of the asset or property to be bought as opposed to the borrower's personal financing background such as credit report score or revenue.

A conventional or bank home loan may occupy to 45 days to close while a difficult cash financing can be enclosed 7 to 10 days, in some cases faster. The ease and also rate that tough money lendings use continue to be a major driving pressure for why investor choose to use them.

Report this wiki page